Contents

- Assigning a break-even point

- Break Even Point Formula in Excel

- Break even point calculation

- The model for calculating the break-even point of an enterprise

- Stages of calculating the break-even point according to A.D. Sheremet

- The first calculation option: we know the costs and sales volume

- The second calculation option: we know the price and costs

- The third calculation option: for the service sector and trade

- An example of calculating the break-even point in Excel

- How to Plot a Break Even Point Chart in Excel

- Where detailed calculations are needed, practice of using

- Advantages and disadvantages of the break-even point model

- Conclusion

The continued success of the company must be maintained, and for this it is necessary to determine the safe boundaries of sales volume. This information can be obtained using the break-even point. Let’s figure out what it is, what is its use, and how to make calculations using Microsoft Excel tools.

Assigning a break-even point

The result of the activity of the enterprise for a certain period of time is income and costs. To find out the level of profit, expenses are subtracted from income, but the result is not always positive, especially if the organization has recently entered the market. The break-even point is an economic situation where income covers expenses, but the company has not yet made a profit.. The coordinate values are zero.

Deriving a break-even point brings an understanding of how much needs to be produced and sold in order to ensure stable development. This indicator is calculated to determine the state of the enterprise. If there are high production and sales indicators above the break-even point, the company works stably, the risks are minimal. Also, assessing the situation from the zero point helps managers make big decisions – for example, to expand production and introduce new methods. The resulting data is provided to investors and lenders to confirm the sustainability of the organization.

Break Even Point Formula in Excel

You can calculate the values at the zero point using this formula: P*X – FC – VC*X = 0. Variable values:

- P – the cost of the product for the buyer;

- X is the volume of production;

- FC – fixed costs;

- VC is the variable cost that a company incurs in producing a unit of a product.

Two variables in the formula especially affect profits – the amount of product produced and non-fixed costs. These indicators are interrelated, their change leads to an increase or decrease in income. In addition to the monetary equivalent, there are natural units – the calculation of the quantity of goods is carried out according to the following formula: X = FC/(P – VC). Fixed costs (FC) are divided by the difference between price (P) and non-fixed costs (VC) to get the amount of product sold needed for stability.

The amount of revenue covering expenses is considered at a known volume of production. The indicator is multiplied by the cost per unit of the good produced: P*X. When the necessary formulas are known, it is time to find out at what indicators the enterprise will be in a neutral state.

Break even point calculation

Economists know several ways to find out the indicators required to hit the break-even point. Each of them uses Microsoft Excel spreadsheets and work with formulas.

The model for calculating the break-even point of an enterprise

Remember! When determining the zero economic moment, ideal numbers and sums are taken.

Deriving a break-even point is an ideal model for the development of an organization; in reality, the results may change due to unforeseen increases in costs or a drop in demand. Consider the assumptions that apply during the calculation:

- the volume of goods produced and the costs are linearly related;

- production capacity and product type remain the same;

- the price and non-fixed costs remain constant in the considered time interval;

- the quantity produced is equal to sales, there is no stock of the product;

- variable costs can be predicted with perfect accuracy.

Stages of calculating the break-even point according to A.D. Sheremet

According to the theory of the economist A.D. Sheremet, the zero point should be determined in three stages. The scientist believes that organizations need information about this indicator in order to stay in the safe zone and expand it as much as possible. Let’s take a look at the steps that Sheremet deduced:

- Obtaining information about the number of products produced, income and expenses, the level of sales.

- Determination of fixed and non-recurring expenses, and after – the zero point and range in which the organization’s work is safe.

- Identification of the appropriate quantity of goods produced and sold for a particular company.

The first calculation option: we know the costs and sales volume

By modifying the zero point formula, we calculate the price of the product, by setting which it will be possible to achieve a neutral value. To start the calculation, you need to get data on the organization’s permanent losses, the cost of goods and planned sales. The formula is written like this: P = (FC + VC(X))/H. VC(X) means that you need to multiply the cost price by the quantity of goods sold. The results in the form of a table will look something like this:

Known data are highlighted in red. By inserting them into the formula, we get the amount of goods sold in rubles or another currency.

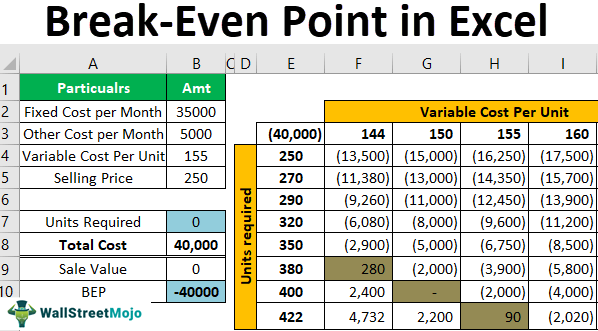

The second calculation option: we know the price and costs

The most popular way to find out the calculation of the break-even point, it is used in organizations with large production. It is necessary to find out how many goods sold will lead the organization to zero losses and profits. To determine this number, the formula for the natural equivalent of the break-even point is used: X = FC/(P — VC).

Known data are fixed and variable costs, as well as the established price of the goods. To determine the monetary equivalent, the price of a product is multiplied by the resulting sales volume in units of the product. The table in this case looks like this:

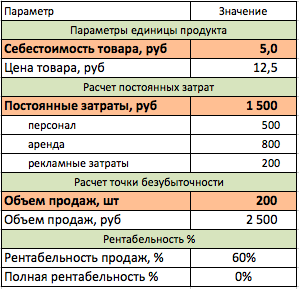

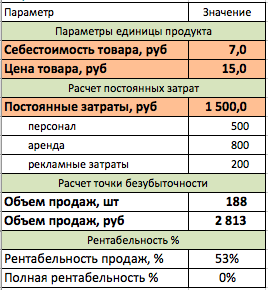

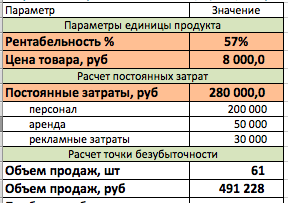

The third calculation option: for the service sector and trade

It is difficult for a merchant or service organization to calculate the break-even point because all goods and services have a different price. The average value will not work – the result will be too inaccurate. The variable in the zero point calculation will be profitability, this indicator plays a role in sales.

Target profitability is the rate of mark-up received when selling a product. To calculate the required amount of revenue (S), you need to know its value (R) and information about fixed costs (FC). Revenue is the target sales volume in rubles. The formula is: S = FC/R.

Let’s make a table with known values and try to determine the revenue necessary for stability. In order to find out the volume of sales in physical terms in the future, we will add the estimated price of the goods. For this, the following formula is used: Sn=S/P. By dividing one value by another, we get the desired result:

An example of calculating the break-even point in Excel

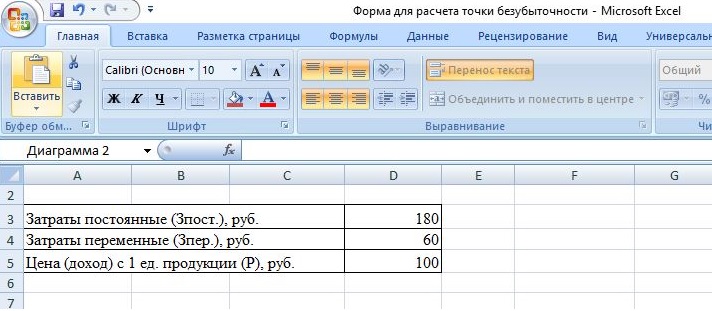

The calculation will be carried out by the second method, since it is most often used in practice. It is necessary to create a table with known data about the work of the company – fixed costs, variable costs and unit price. Displaying information on a sheet will help us further simplify the calculation using a formula. An example of the resulting table:

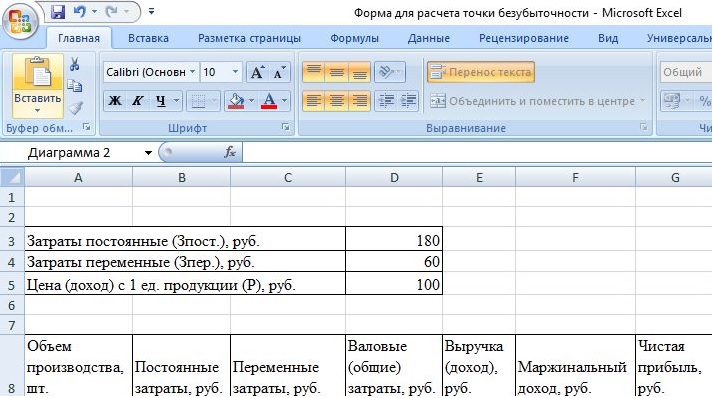

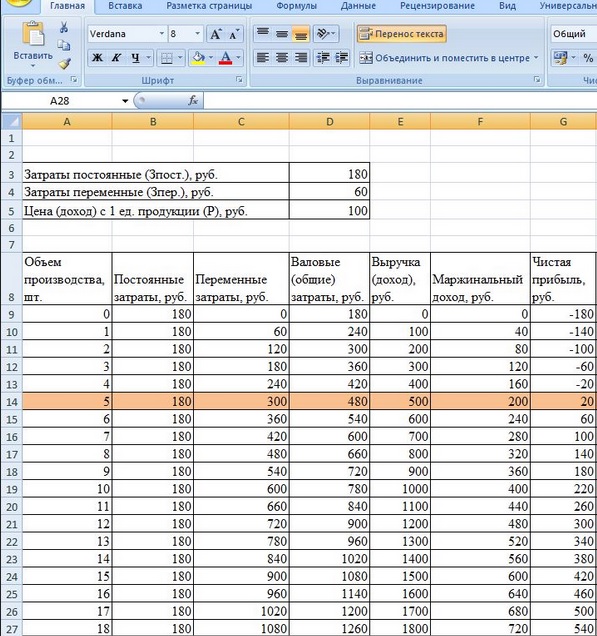

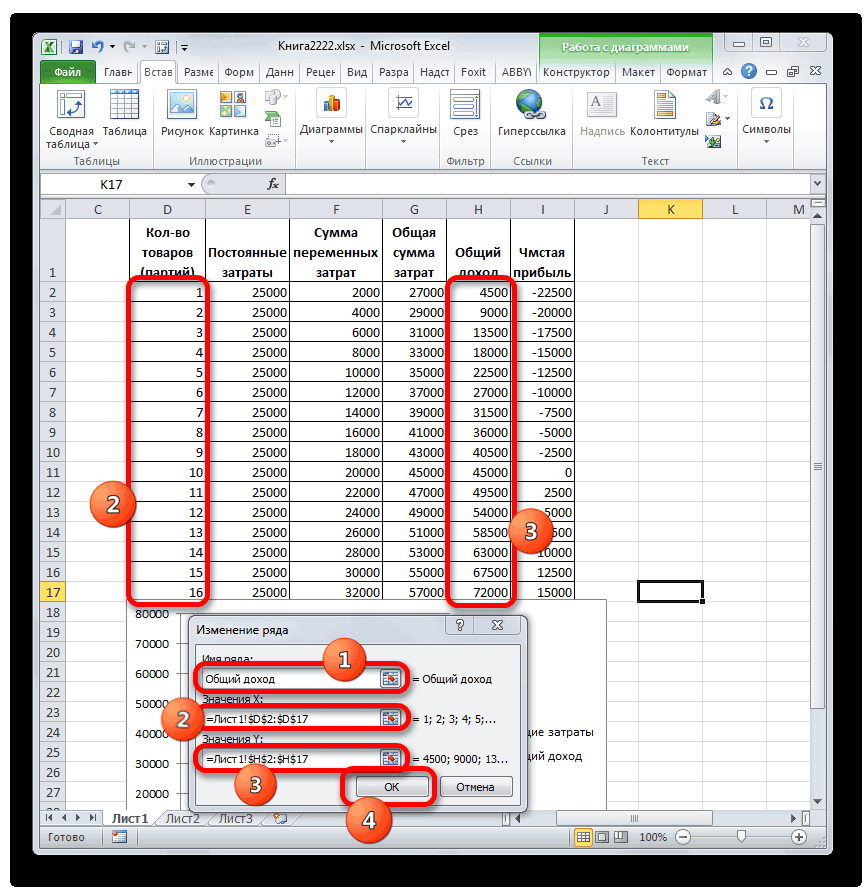

Based on the recorded data, a second table is built. The first column contains data on the production volume – you need to create several rows for different periods. The second consists of repeating cells with the sum of fixed costs, variable costs are in the third column. Next, the total cost is calculated, column 4 is compiled with these data. The fifth column contains the calculation of the total income after the sale of a different number of products, and the sixth – the amount of net profit. Here’s what it looks like:

Calculations for columns are carried out using formulas. Cell names can be entered manually. There is another method: enter the “=” sign in the function line and select the desired cell, put the desired mathematical sign and select the second cell. The calculation will occur automatically according to the created formula. Consider the expressions for calculating the data in each row:

- variable costs = production volume * fixed costs;

- total costs = fixed + variable;

- revenue uXNUMXd production volume * total costs;

- marginal income uXNUMXd revenue – variable costs;

- net profit / loss = revenue – total costs.

The resulting table looks like this:

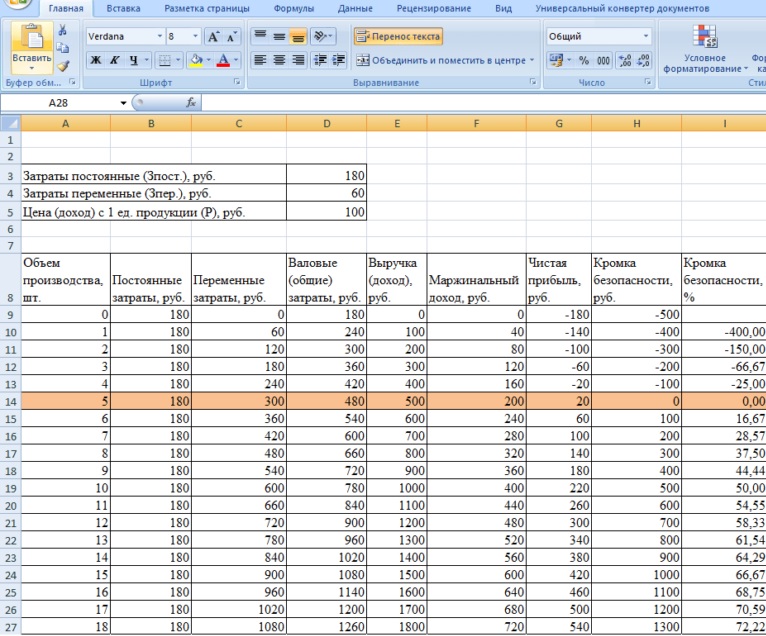

If none of the strings ends with a zero in the result, you will have to do some more calculations – to find out the value of the margin of safety / margin in percentage and in money. This value shows how far the company is from the breakeven point. Create two additional columns in the table.

According to the safety margin formula in monetary terms, you need to subtract from each value of revenue that positive value of it, which is closest to zero. In simplified form, it is written like this: KBden uXNUMXd Vfact (actual revenue) – Wtb (revenue at the security point).

To find out the percentage of safety, you should divide the value of the monetary margin of safety by the amount of actual revenue and multiply the resulting number by 100: KB% u100d (KBden / Vactual) * XNUMX%. The break-even point can be more accurately determined from the safety edge, as shown in the image below:

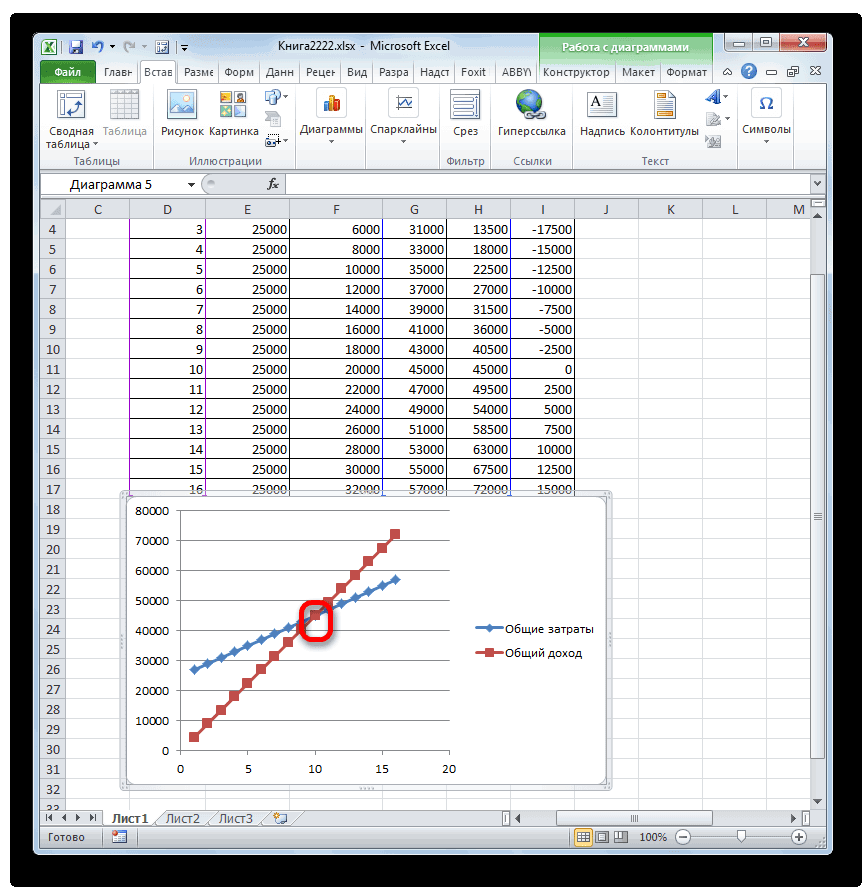

How to Plot a Break Even Point Chart in Excel

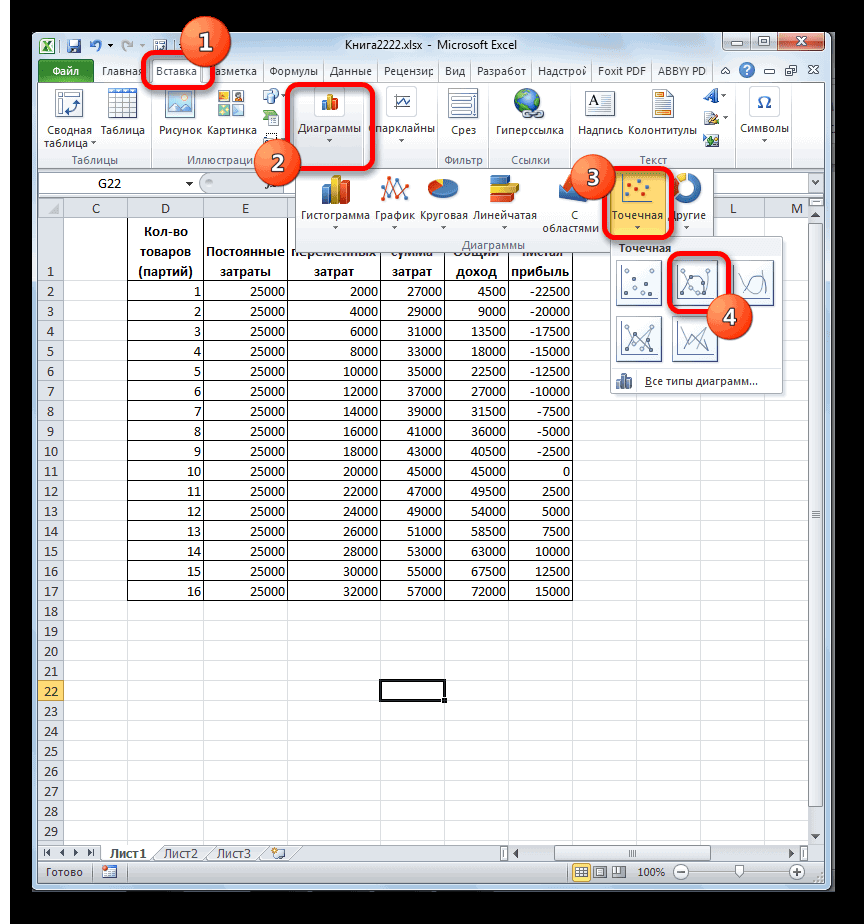

The graph visually reflects at what point the profit becomes greater than the loss. To compile it, we will use Excel tools. First you need to select the “Insert” tab and find the “Charts” item on it. When you click on the button with this inscription, a list of templates will appear. We choose a scatter plot – there are also several of them, we need a diagram with curves without sharp bends.

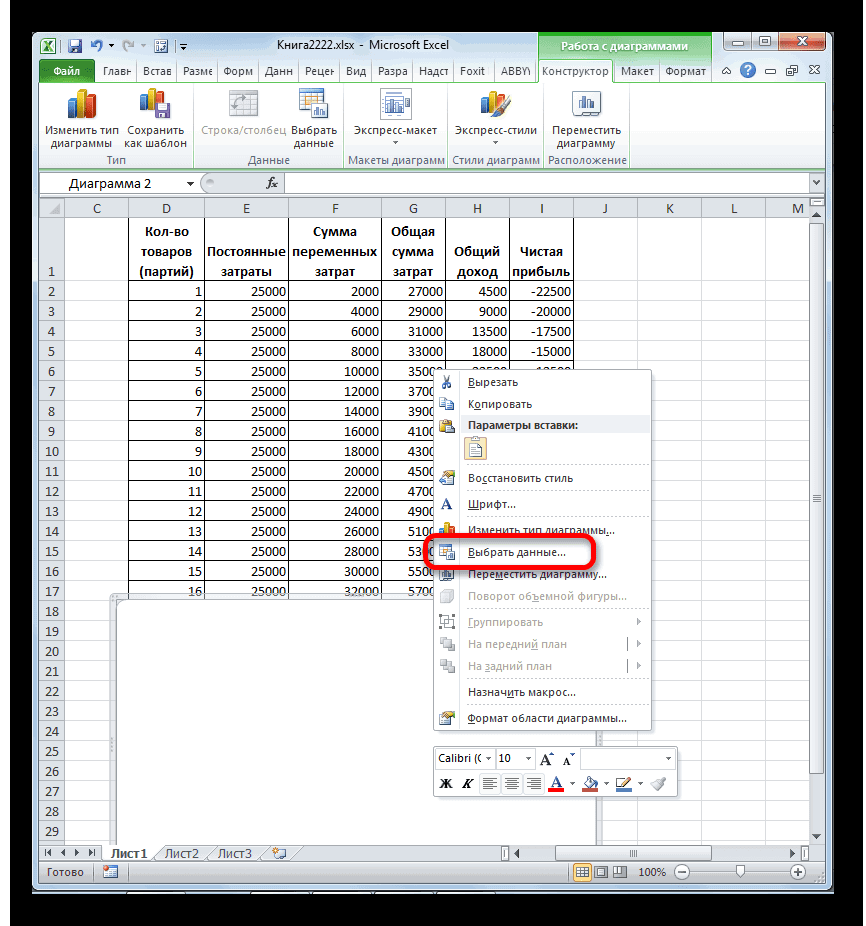

Next, we determine what data will appear on the chart. After right-clicking on the white area, where the diagram will later appear, a menu will appear – you need the “Select Data” item.

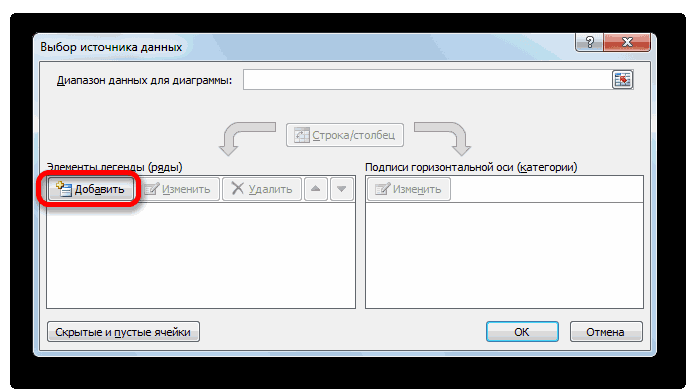

In the data selection window, find the “Add” button and click on it. It is located on the left side.

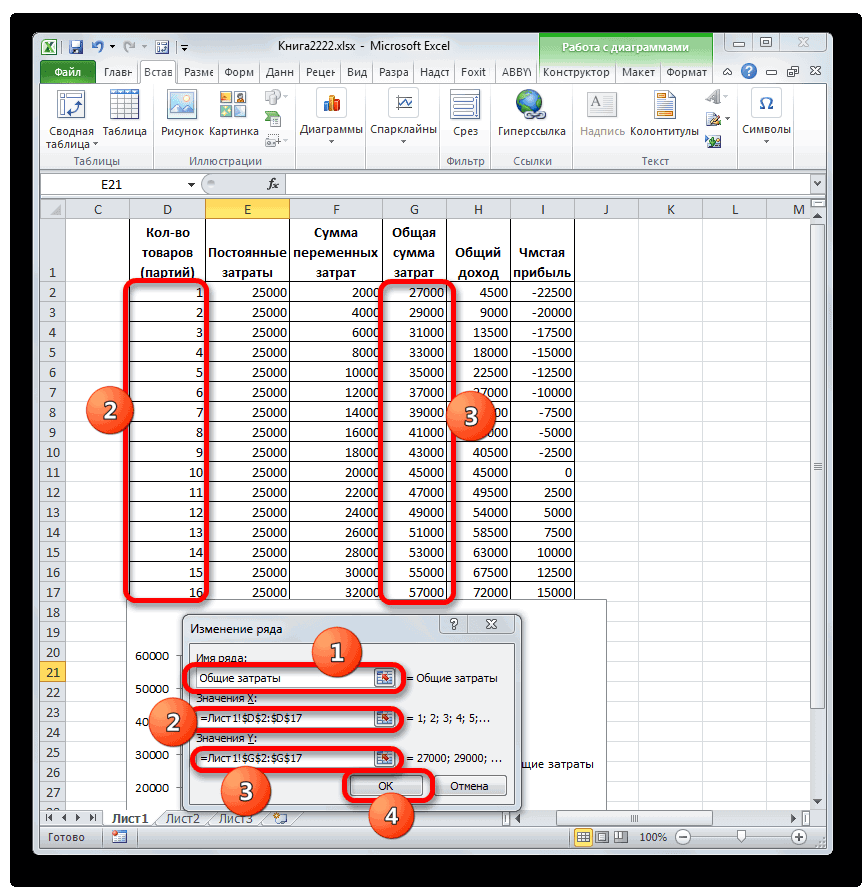

A new window will appear on the screen. There you need to enter the ranges of cells in which the data for one of the branches of the chart is located. Let’s name the first graph “Total costs” – this phrase must be entered in the line “Series name”.

You can turn the data into a graph as follows: you need to click on the line “X Values”, hold down the top cell of the column and drag the cursor down to the end. We do the same with the line “Values Y”. In the first case, you need to select the column “Number of goods”, in the second – “Total costs”. When all fields are filled, you can click “OK”.

Click “Add” again in the data selection window – the same window as the previous one will appear. The series name is now “Total Income”. The X values refer to the data in the cells of the “Number of Items” column. The “Y Values” field must be filled in, highlighting the “Total Income” column.

Now you can click the “OK” button in the “Select Data Source” window, thereby closing it. A graph with intersecting lines appears in the chart area. The intersection point is the breakeven point.

Where detailed calculations are needed, practice of using

Deriving a break-even point helps in various areas where the financial side plays an important role. Within the company, calculations can be carried out by a financial analyst, development director or owner. Knowing the values of the zero point will help to understand when the enterprise is profitable, in what state it is at a particular point in time. The sales plan can be drawn up more precisely, knowing the break-even point.

If a lender or investor has enough data about the company, he can also determine the reliability of the organization by the break-even point and decide whether it is worth investing in it.

Advantages and disadvantages of the break-even point model

The main advantage of this model is its simplicity. Three ways to determine the break-even point are within the power of anyone who has Microsoft Excel on their device. The problem is that the model is conditional and limited. In practice, unexpected changes in one of the indicators may occur, due to which the results of the calculations can be considered useless. If the demand for products is unstable, it is impossible to determine the exact volume of sales in advance. It is also influenced by other factors – for example, the quality of the work of the marketing department.

Conclusion

Calculating the break-even point is a useful practice for long-running businesses with stable demand for products. Focusing on this indicator, you can plan a work plan for some time in advance. The break-even point shows at what volume of production and sales the profit completely covers the losses, determines the company’s safety zone.