Contents

- How to get a tax deduction when buying an apartment

- Contents:

- What is a tax deduction?

- What can and cannot be deducted for?

- How much can you get?

- How many times can a deduction be issued?

- How can spouses receive up to 650 thousand rubles each?

- How do I get a deduction? 2 ways.

- What documents are required to register a deduction?

- How to send documents online. Step-by-step instruction.

- What can and cannot be deducted for?

- How many times can you get a deduction?

- How can spouses receive up to 650 thousand rubles each?

- How do I get a deduction? Two ways

- What documents are required to register a deduction?

- To receive a deduction from an employer, you need:

How to get a tax deduction when buying an apartment

If you bought a home, you can return up to 650 thousand rubles. Wday.ru will help you figure out what documents are needed, how to collect them and send them to the tax office.

Contents:

What is a tax deduction?

What can and cannot be deducted for?

How much can you get?

How many times can a deduction be issued?

How can spouses receive up to 650 thousand rubles each?

How do I get a deduction? 2 ways.

What documents are required to register a deduction?

How to send documents online. Step-by-step instruction.

If you bought a house, apartment or land plot and at the same time regularly paid 13% of personal income tax (personal income tax or income tax), you have the right to return up to 13% of the cost of housing. This is called “property tax deduction” and is described in Art. 220 of the Tax Code of the Russian Federation.

In the same way, you can return up to 13% of the paid mortgage interest if the house was bought with a mortgage.

What can and cannot be deducted for?

The law prescribes the following categories of expenses for which you can receive money:

purchase and construction of housing (apartment, private house, room, shares in them);

acquisition of a land plot for the construction of a residential building or with a residential building located on it (shares in them);

interest on targeted (mortgage) loans for the construction or purchase of housing, as well as, under certain conditions, interest on loans for refinancing and refinancing for targeted housing loans (clause 4 of article 220 of the Tax Code of the Russian Federation);

repair and decoration of housing, if it was purchased from the developer without finishing; completion of the purchased house, etc .;

But there are also spending limits. You cannot receive a deduction for:

housing purchased from a spouse, parents, children, siblings, employer and other interdependent persons;

housing purchased after the buyer has exhausted his right to a property deduction (more on this below).

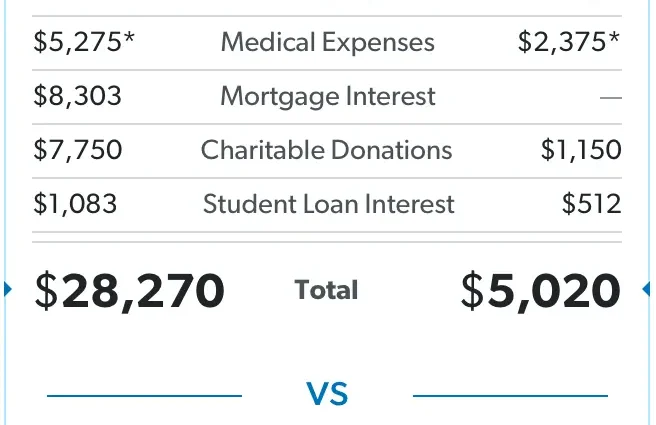

The maximum amount that can be refunded after the purchase or construction of a home is 2 million rubles… That is, the tax deduction (13% of this amount) will be 260 thousand rubles. But if you purchased the property before 2008, then the deduction will be calculated from the amount of 1 million rubles. In this case, it will turn out to return 130 thousand rubles.

All 260 or 130 thousand rubles at a time can be obtained if for a year personal income tax was withheld from your salary (or other income) greater than or equal to this amount. For example, if in a year you earned 2 million rubles (about 167 thousand per month), then 260 thousand will just amount to 13% and must be returned in full. If in a year you earned (and deducted to the treasury) less, then you can receive a deduction for several years until the total amount of the refunded tax reaches 260 or 130 thousand rubles.

If an apartment or house was bought with a mortgage, then you can still return 13% of the amount of interest paid on the loan. This is the so-called mortgage interest deduction. In this case, the maximum amount from which the deduction will be granted will be 3 million rubles. That is, on mortgage interest, you can count on a deduction of 390 thousand rubles.

Please note that the ceiling on loan interest applies if the home was purchased after January 1, 2014. If the property was bought earlier than this time, then the interest will be refunded for the entire amount of interest paid, without restrictions.

Let’s summarize both deductions: after buying an apartment, you can get up to 650 thousand rubles of property deduction.

Council

As a rule, people first draw up a property deduction (since the amount in it is already determined from the cost of housing), and after a few years, when the amount of mortgage interest has accumulated and the property deduction is exhausted, they draw up a deduction for mortgage interest.

How many times can you get a deduction?

At first, the amount of property deduction from 2 million rubles can be taken not from one, but from several purchases. For example, if the first purchase of housing was in the amount of 1 million rubles, and the second – for 3 million, then 130 thousand rubles can be taken from the first purchase, and then the remaining 130 thousand rubles can be taken from the second purchase. The main thing is that the total amount of the property deduction will be 260 thousand.

Secondly, this is affected when the property was purchased. If the home was bought before January 1, 2014, then the property deduction can be issued only once, and it will not be affected by the value of the property. For example, if in 2013 you bought an apartment for 1,3 million rubles and returned the paid personal income tax, and in 2018 you bought housing again, then you will not be able to get the remaining 700 thousand rubles (from the maximum amount of 2 million rubles).

If the apartment was purchased after January 1, 2014, then the deduction can be issued several times, but provided that you have not used this right before. True, one must understand that even in this case, the maximum refund amount will be 260 thousand rubles (from 2 million) and 390 thousand rubles (from 3 million), respectively.

Council

As for the mortgage interest deduction, it can only be used once per mortgage. If for the very first apartment bought on a mortgage you began to return a deduction on mortgage interest and did not even use the entire limit of 3 million rubles, it is no longer possible to draw up such a deduction for the next mortgage.

How can spouses receive up to 650 thousand rubles each?

A very important point: if housing is purchased after January 1, 2014 in marriage, then the right to a property deduction arises for each of the spouses. That is, both husband and wife can each return the amounts described above.

Council

The main thing is that each of the spouses immediately upon purchase formalizes the purchase of their share in the apartment, and not simply rely on the law on the common ownership of housing acquired in marriage.

If the apartment was bought after January 1, 2014 as a common share ownership, then the right to deduction between the owners is distributed according to the expenses of each for the purchase of housing. For apartments purchased before January 1, 2014, the amount of the deduction between owners is calculated based on their shares.

How do I get a deduction? Two ways

It’s not difficult at all. The deduction after the purchase of an apartment can be obtained in two ways.

The first method – wait until the end of the year and apply to the tax office at the place of residence with the documents by submitting a declaration in the form of 3-NDFL. What documents will be needed, described in detail below. The tax authorities will accept the documents, register the application, check the submitted declaration and transfer the personal income tax withheld for the past year to the owner’s account.

second method – do not wait until the end of the year and receive a deduction from the employer (he will no longer withhold personal income tax) from the year in which the purchase was made. To do this, you also need to contact the tax office with a package of documents and receive a notification from the inspectorate confirming the right to a property deduction. This notification must then be taken to the employer’s accounting department. After that, personal income tax will no longer be withheld from salaries and all tax withheld from the beginning of the year will be returned.

For example, you bought an apartment in June 2020, decided not to wait for the year to end, and brought your employer a notice from the tax office in July. From August, the accounting department will not withhold personal income tax from salaries and will make a refund of the tax that was withheld from January to June.

Council

A caveat is needed here: according to the law, the accounting department can recalculate and return the entire personal income tax withheld from the beginning of the year. But sometimes employees of the accounting department are afraid and do not risk doing it. The fact is that the tax code does not indicate from which month the personal income tax should be returned – in the notification that you will be given to the tax office, only the year is indicated. In this case, if, upon notification, you simply stop withholding personal income tax, then you can return the personal income tax already withheld from the beginning of the year at the beginning of next year according to the 3-personal income tax declaration.

What documents are required to register a deduction?

To get a deduction through the tax office, you will need:

Fill in the declaration in the form 3-NDFL.

Provide a 2-NDFL certificate (or choose from those displayed in your personal account on the tax website).

Prepare copies of documents confirming the ownership of the apartment, house.

Make copies of payment documents.

The package of documents can be taken to the tax office in person or sent electronically through your personal account on the website nalog.ru. To create a personal account on the tax website, it is enough to contact any regional tax office with a passport and ask for a one-time password. It will take effect within 2 hours. You will create a personal account, change your password and you will be able not only to submit documents for tax deduction, but also to track and pay incoming taxes, view XNUMX-NDFL certificates from the employer, etc.

Within three months after the submission of the documents, the inspectorate will check the declaration and documents. If everything is in order with them, then within 30 days you will receive a deduction to the bank account specified in the application.

We submit a 3-NDFL declaration on the tax website: step by step instructions

We go to the site nalog.ru, enter a one-time password in your personal account. Then we change it to ours.

Council

If the office inspector has any questions during the inspection, he will contact you and ask you to bring some documents or write an explanation. By the way, you can keep in touch with the office inspector of your tax office. It is enough to call your district tax office, give your surname (taxpayers are assigned to inspectors in alphabetical order) and take his internal phone number. So you can quickly deal with documents or ask questions.

To receive a deduction from an employer, you need:

Get a 2-NDFL certificate for the current year from the accounting department.

Prepare documents confirming the ownership of the apartment, house.

Make copies of payment documents.

Write an application for notification in the form approved by the tax office.

All documents must be taken to the tax office or submitted through a personal account on the website nalog.ru. To do this, in the section “Life situations” you need to select “Request a certificate and other documents”, then – “Get a certificate confirming the right to receive property deductions.” In the finished form, you need to fill in the fields with information about the property and the employer and send a request.

If everything is fine with the documents, the tax office will issue a notification in 30 days, which will remain to be referred to the accounting department. Sometimes the certificate is ready earlier, you can check with the office inspector.

We request a deduction certificate from the employer on the tax website: step by step instructions

We go to the site nalog.ru, enter a one-time password in your personal account. Then we change it to ours.

Alfiya Tabermakova, Svetlana Valieva