Contents

Every person wants to live a rich, interesting life, and not survive from paycheck to paycheck. Almost any desire requires money to come true: a new house or car, a hobby, an education for children, even a simple walk in the park is rarely complete without a cup of latte. It is a natural need to live comfortably. And in this digest there are only 8 simple steps to achieve wealth and prosperity.

1. Optimize spending

There is no need to give up all purchases at once, but keeping a diary of expenses for 2-3 months will allow you to see what the bulk of the money is spent on. Break all expenses into several categories: food, clothing, utility bills, transportation, and so on. The list should be right for you.

During the entire period when you keep a diary, do not try to analyze it or scold yourself. Just write down all the expenses in a systematic way, putting them in the right category. After 2-3 months, you will only have to take a critical look at the resulting data. If the result suits you, great. If not, think about what you can give up without harming yourself in order to reduce spending.

2. Increase your income

So, the first step has been taken. You have optimized your expenses and stopped spending money on unnecessary and, most importantly, unpleasant things. But it is not possible to achieve welfare by reducing spending alone. The next step should be a systematic increase in your income.

Assess your current salary. Compare it with the market average. If you get less than specialists in similar positions, talk to your manager about a promotion. If this step doesn’t work, it’s time to think about changing jobs. Owners of their own business should also evaluate their financial performance and compare them with the performance of companies in your segment. If there are significant discrepancies, it is important to understand what the cause is and eliminate it.

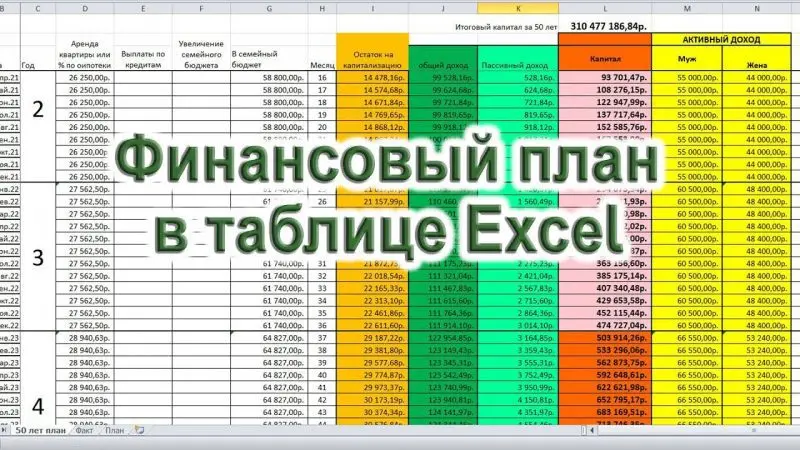

3. Make a financial plan

The human brain is arranged in a very interesting way: for any action it needs a specific goal, otherwise it will be ready to spend energy on anything, but not on what you really need. Therefore, be sure to draw up a financial plan, even the simplest and most approximate. Decide how much money you need on a monthly basis. Plan big purchases. Consider the cost of education and upbringing of children, the allocation of separate housing for them, or funds for the down payment on a mortgage.

Don’t forget to include at least 10% of your planned contingency expenses. It is also important to take into account inflation – if today your dream apartment is worth 5 million, in 5 years its value may increase significantly. Once the plan is ready, take a close look at it. Is this really what you want? If you have included in the plan items imposed by your environment: parents, friends, colleagues – such a plan will not give you enough motivation.

4. An airbag is not a luxury, but a necessity

And now a little about unforeseen circumstances. Nobody likes to think about the bad, but different events happen in life, and it is better to foresee them in advance. You may lose your job or get sick. Your refrigerator or car could break down. But contingencies don’t have to have negative connotations. You may get an unexpected job offer in another city with a raise in salary, but you need money to move. Or do you have a wedding planned and you need money for it?

Be that as it may, an airbag will help you feel confident even when there is a change, be it a change for the good or the bad. The optimal airbag size is your monthly expense multiplied by a factor of three to six. In other words, this money should give you three to six months to last, even if all sources of income have disappeared.

5. Monetize your hobby

Do you like to embroider? Perfectly. Don’t leave home without a camera? Better. Any hobby can be turned into a source of income without detracting from its attractiveness to you. Any handicraft items can be sold through social networks, simply by uploading them to your page. There are many stock services out there for selling photographs, and someone is sure to pay for a good shot.

Since this will only be an additional source of income, you do not have to deal with marketing and promotion issues. Just watch how small but pleasant amounts are credited to your account. If they start to grow, why not think about turning your hobby into something more?

6. Invest in yourself

Any person is at the same time a commodity in the labor market. The more knowledge and skills you have, the broader your horizons, the higher your value. It is important to develop not only subject skills: programming, the ability to work with databases or the skill of a builder, but also the so-called soft skills: emotional intelligence, negotiation skills, problem solving skills.

Investments in yourself, in your education and development will certainly pay off, albeit indirectly. Learn languages, attend online and offline courses and lectures, think about getting additional higher education. Do not be afraid to take a step away from your professional activity: after the course in interior design, you may want to change the field of work and your whole life.

“Money attracts money” is a truth that is hard to argue with. Be honest about the people you interact with on a daily basis. What position do they occupy? What message is being broadcast to the world? If everyone you know is suffering from a lack of money, you too will inevitably start thinking in terms of poverty. If you are surrounded by energetic people who are ready to work for a secure life, their enthusiasm cannot fail to capture you.

Of course, this rule does not apply to family and closest friends. Not everything in the world is measured by money, and there is nothing more important than a sincere and warm relationship. But if a person who plays a small role in your life is completely eliminated from the financial flow – think, would you be better off without him?

8. Invest

Even if you love your job very much, you hardly want to work your whole life. Of course, there are exceptions, and some successful businessmen did not leave the race until the end of their days, but sooner or later most people want to stop the frantic race and rest in a quiet haven. But for this vacation you need money, namely passive income. A pension will barely cover the most basic needs, and a wealthy person wants to live with dignity in old age.

So invest. Don’t be afraid to get started – read a few books about different investments, pick the one that’s right for you. Invest in bonds and shares of reliable companies, buy currency. Do not be intimidated by crises in the market and do not rush to sell your assets every time they fall. Wait. In the long term, investing is practically the only way to get a reliable passive income.

Start implementing any of these eight points in your life now, and you will soon see improvements. Remember – the path to wealth and prosperity begins with the first step.