Contents

Atlanta Business Club and Smart Ranking have compiled a rating of the largest and most dynamically growing transport sharing companies in our country. The leader in revenue was Yandex.Drive, in terms of growth dynamics — kicksharing Whoosh

The rating became part of the Atlanta 1000 project. Its goal is to identify the fastest growing companies in our country from the segment of small and medium-sized businesses from 2018 to 2020.

Mikhail Voronin, entrepreneur, founder and senior partner of the Atlanta Business Club:

“We talk a lot about the fact that life is changing rapidly. What is a change marker? For example, the sharing economy.

As part of our next thematic rating “Atlanta 1000”, we considered transport sharing. Gradually, we got used to short-term car rental, and now the largest car companies offer cars for long-term rental. In the summer, we saw a boom in scooters, and now we see how special associations and legislative initiatives appear that regulate this area. To see where the industry is heading, you need to have a clear understanding of market dynamics. We noted the main trends as part of our study.”

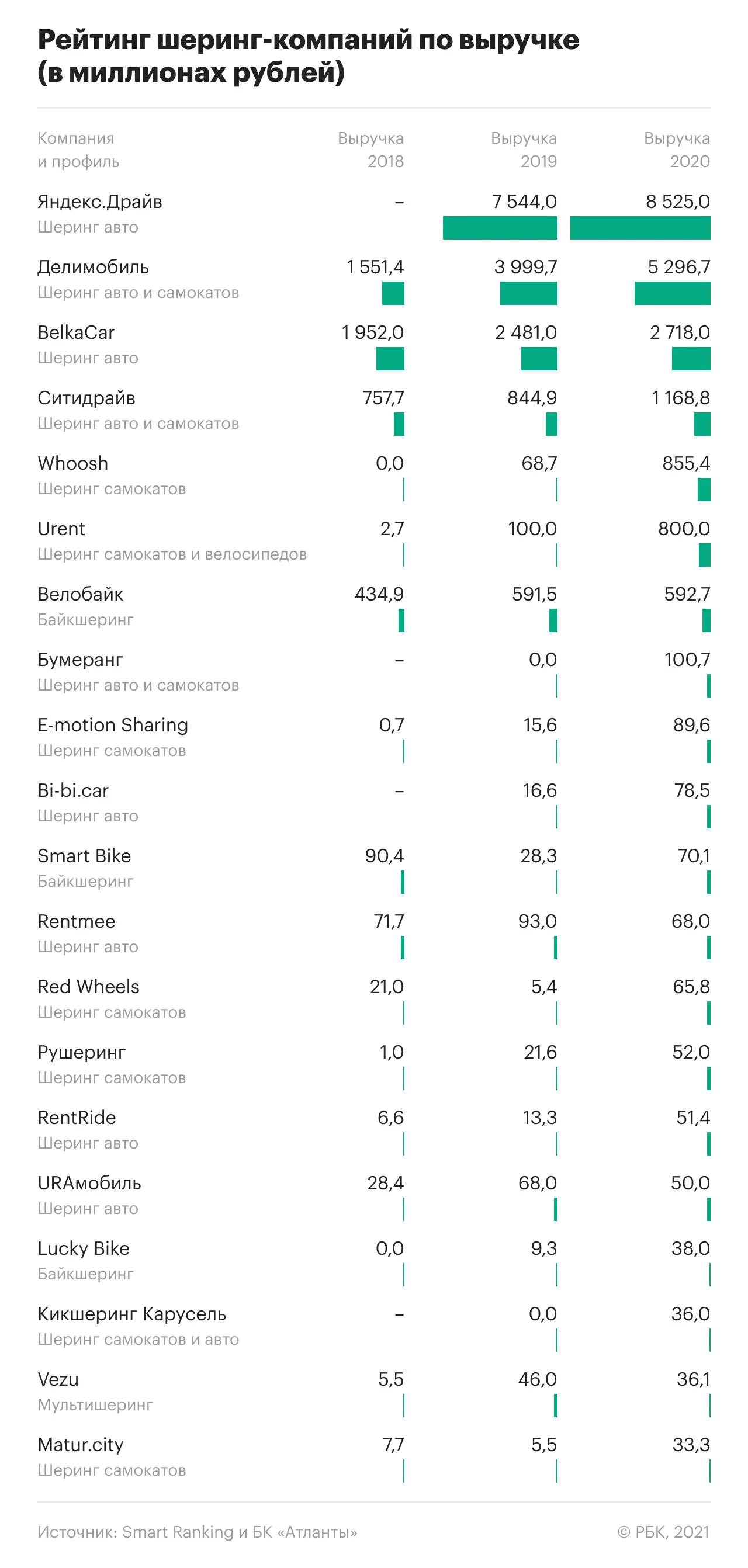

The total revenue of the top 20 transport sharing companies in our country for 2020 amounted to ₽20,7 billion, which is 30% more than in 2019. In total, since 2018, the market has grown by about four times. 85% of revenue was generated by carsharing services Yandex.Drive, Delimobil, Belkacar and Citydrive. Nevertheless, the kicksharing operators Whoosh and Urent for 2020 have already approached ₽1 billion in revenue each and are leaders in terms of growth dynamics.

The full version of the rating can be found at the link.

Analysts expect that by the end of 2021, the ratio of segments may change significantly. “2021 has been a really explosive year for kicksharing,” says Yuri Nikolaev, publisher of the Thrushering project. “Companies did not keep up with their own growth, urgently bought more scooters, and as a result, we are likely to see crazy growth figures.”

Car sharing: a challenging year

According to the rating, the car sharing market in 2020 grew by about 20%. In the second quarter of 2020, carsharing was banned in Moscow, which negatively affected the results of the year. But at the same time, car sharing operators, like a number of other IT services, call themselves one of the beneficiaries of the lockdown. “The results of 2020 were even better than the year before, despite a complete ban on activities for two and a half months,” says Loriana Sardar, CEO BelkaCar. – This is primarily due to the overall increase in load, since immediately after the lockdown, the demand for car sharing services increased significantly. Revenue per BelkaCar vehicle is up over 60% from pre-COVID-19 levels.”

According to BelkaCar, the capacity of the capital’s car sharing market is about $700 million, the capacity of the entire Russian car sharing market is $1,5 billion. In other words, the market will potentially quadruple in the next five years.

“All carsharing in Moscow for a whole quarter were forced to just burn money,” says Yuriy Nikolaev. “Therefore, they did not have impressive growth in 2020. A comparison of 2019 and 2021 will be more revealing, although even there it will be necessary to take into account that there was not only organic growth, but also the expansion of the fleet, coupled with an increase in prices.”

There are four clear leaders on the market today, far ahead of other operators: Yandex.Drive, Delimobil, BelkaCar and Citydrive. At the same time, Yandex.Drive’s revenue is more than that of its two closest competitors combined. Compared to 2019, in 2020 it increased by about 13%.

Kicksharing: Preparing for Explosive Growth

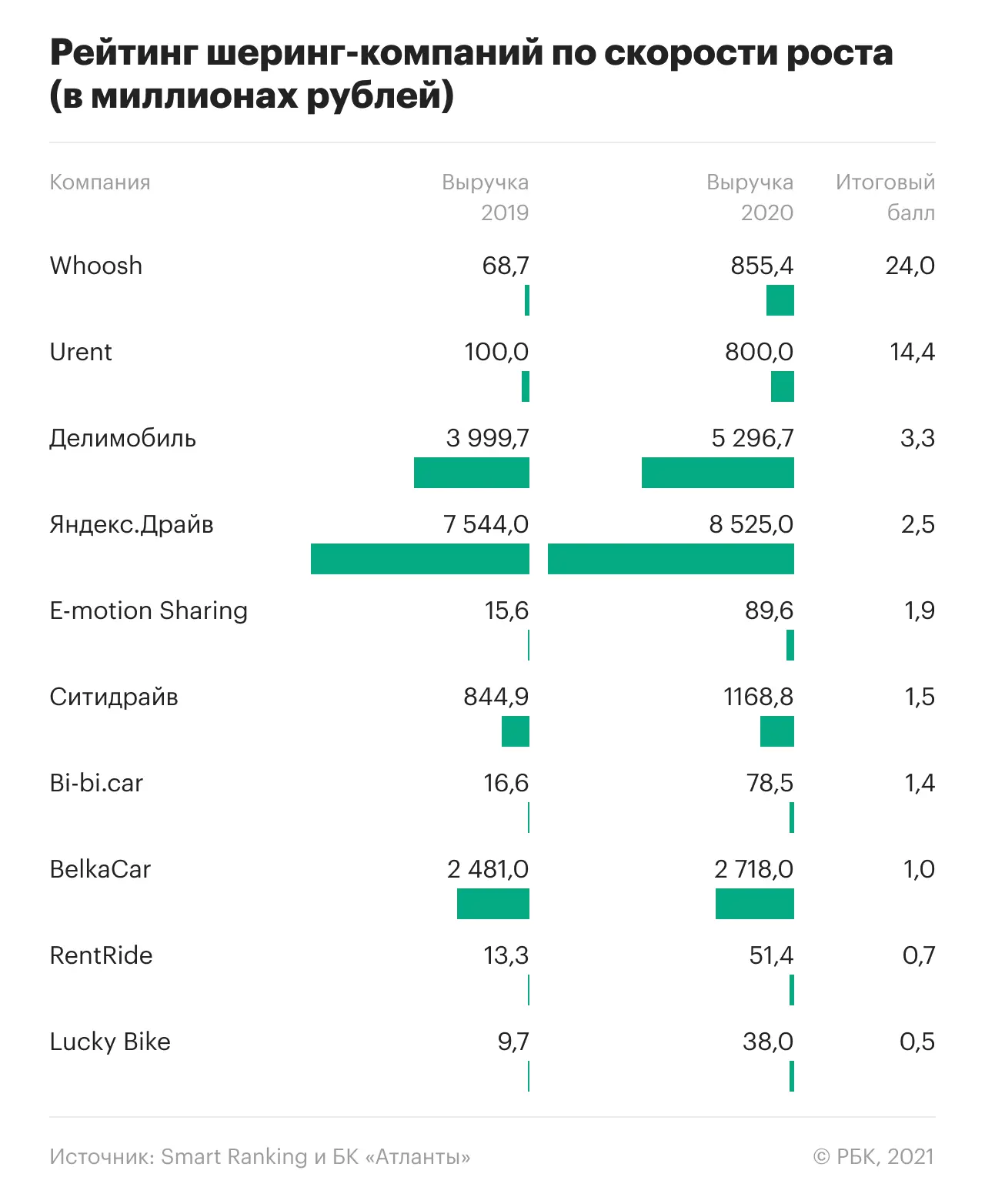

The main competition for the kicksharing market is between Whoosh and Urent. They became leaders in terms of growth dynamics among transport sharing companies, calculated using the Smart Ranking formula. Both companies call themselves leaders in their market, both noted that the surge in demand in 2020 was spurred on by the pandemic.

The full version of the rating can be found at the link.

“Demand in 2020 was much higher than we expected. We realized this in March 2020, having received record revenue figures for the entire existence of the service, – says Andrey Azarov, co-founder of the Urent kicksharing service. “We revised the forecast, attracted investments and were able to become the largest player in the kicksharing market in our country.”

At the beginning of 2021, Whoosh also received investments – from VTB Capital Investments and the structure of Otkritie Bank PJSC in the amount of $25 million. , — and in terms of the quality of service and revenue, ”says Dmitry Chuiko, co-founder and CEO of Whoosh.

As for smaller market participants, taking into account the fact that most of them had revenues of up to ₽2020 million in 100, we can say that almost everyone had starting positions in order to enter the top 5. In addition to companies from the top 20, experts name BusyFly, Molnia, toGo and the Russian division of the Belarusian Eleven as contenders.

“With the entry of the first big technology companies into this market, the same bloody battle will begin there, as it was two years ago in carsharing. In the end, only three or four big players with the deepest pockets will remain, ”I’m sure Daniil Kozlov, GVA Managing Partner.

“In three years, there will be about 200 sharing electric scooters in our country, and this service will be in 200 cities of the country (now there are about 70 scooters in 70 cities), predicts Sergey Chetverikov, Investment Director of Kicksharing Karusel. “Riding an electric scooter will become a common daily practice for 30 million people: on the way from work to the subway, or within their own neighborhood.”

Bikesharing

Bicycle sharing companies increased their revenue for 2020 the least – by 13%. According to market participants, a paradoxical situation occurred with bikesharing – even before the market developed sufficiently, scooters began to crowd it. As a result, many who originally entered the market with bicycles have changed their business model, refocusing on kicksharing.

“There is some space for bicycles,” says Yuriy Nikolaev. – From the point of view of romance and the illusion that Moscow is a European city. But in reality this is not the case, because there is no sufficient infrastructure for this market to develop. There are prospects for electric bikes that will be offered by the same kicksharing companies, but it will be a niche story.”

Future prospects

It can be concluded that the transport sharing market in the coming years will be represented by two main segments. At the same time, according to Yuri Nikolaev, in our country, the potential of kicksharing in the next four to five years is head and shoulders above that of carsharing. “Kicksharing doesn’t have many stop factors: it doesn’t need a license, inventory is cheaper, and this is the kind of business that entrepreneurs with small revenues in small towns can work with, which carsharing cannot afford,” he lists. “They are not as dependent on the infrastructure and benefits provided by cities.”

As a promising direction, market participants call the segment “car by subscription”.

“A number of players have entered this segment and are showing phenomenal growth, although this is growth from small numbers,” I agree Dmitry Kalaev, partner of the FRII invest venture fund. The car sharing market is also waiting for further intensification of competition and, as a result, consolidation and transactions. Yandex.Drive and Belkacar are companies that are now actively fighting for performance indicators, says Daniel Kozlov. — There are players who, on the contrary, burn a lot of money, trying to take even more market share. But in general, this is not the best strategy: it only works as long as there is stable funding in large volumes.

You can read more about the calculation method here.